whiskeytangofoxtrot

Slut Guru

- Joined

- Feb 19, 2015

- Posts

- 1,742

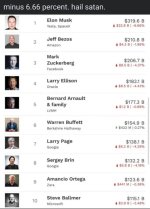

april 1st would be more appropriate for this fool of an administration, but, then again, it's just a concept. geezusfuckingchrist someone find a coloring book and explain it to trump and companyWith more to come April 2nd.