4est_4est_Gump

Run Forrest! RUN!

- Joined

- Sep 19, 2011

- Posts

- 89,007

By John Browne

FEBRUARY 10, 2013

John Browne is a Senior Economic Consultant to Euro Pacific Capital. Opinions expressed are those of the writer, and may or may not reflect those held by Euro Pacific Capital, or its CEO, Peter Schiff.

FEBRUARY 10, 2013

In recent years, a high degree of economic, financial, and political uncertainty has resulted in acute volatility in stocks, real estate, commodities and precious metals. I believe that another aggravating factor has been the increasing skepticism through which the investing public views government statistics and statements.

To make prudent decisions, investors need to know key economic indicators such as economic growth, inflation rates, unemployment levels and the real cost and value of money. For the past 20 years or so, the key assumptions behind the calculation of these figures have been changed, or more accurately distorted, in favor of government image.

Perhaps the most important government statistic for investors is the inflation rate. The precise degree to which money is depreciating is the bedrock upon which all other financial determinations rest. The inflation rate is the prime input that determines the discount rate used for calculating the real present value of investment returns.

The basic U.S. inflation rate is published in the form of the Consumer Price Index (CPI). This purports to represent items selected to represent the spending of the average U.S. citizen. But a closer look reveals some troubling distortions. For example, health care expenditures are weighting at just one percent of spending. Americans who are struggling with obscenely high medical costs will recognize this as absurd on its face.

In addition to weightings, the actual price increases are largely arbitrary. For example, if the price of an automobile rises by 20 percent, but is 'assumed' to have added technology that equated to three quarters of the higher price, the price is deemed to have risen by only 5 rather than 20 percent. (See Peter Schiff's mid January article that shows, among other things, that the government reported newspaper and magazine prices to have risen just 35 percent over the past 12 years while actual prices rose by more than 130 percent.)

For the past few years, the Fed has maintained that the U.S. inflation rate, which is represented by the Consumer Price Index, or CPI, has hovered around two percent. Most consumers who buy food, goods and services such as health in the real world, will find this figure derisory.

However, Shadow Government Statistics (SGS), an independent data service published by John Williams, calculates key U.S. Government statistics according to the methodology used during the years before the election of President Clinton. Using those yardsticks, SGS shows the U.S inflation rate over the past few years has hovered around six percent, or three times the declared Government rate.

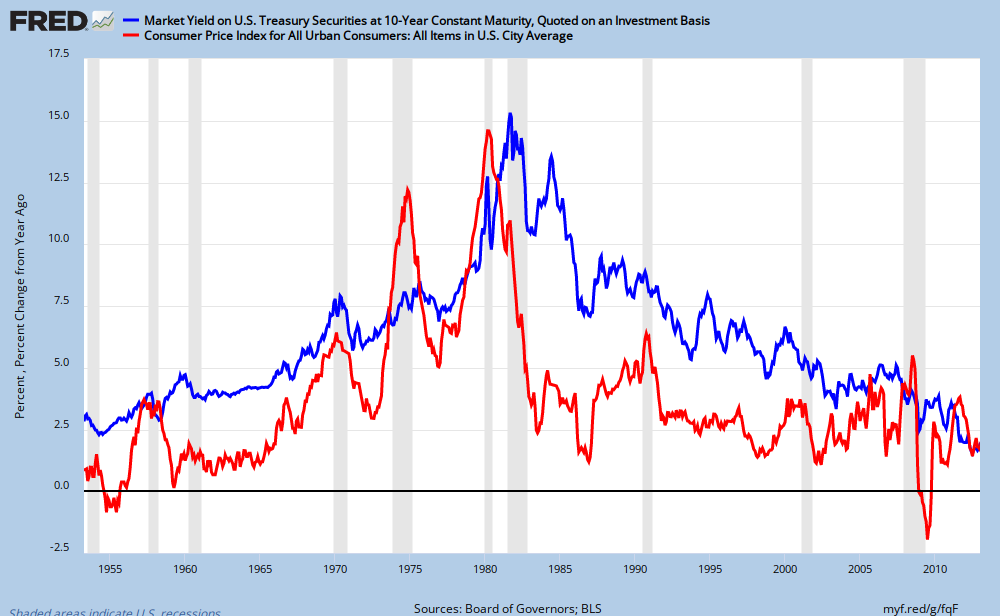

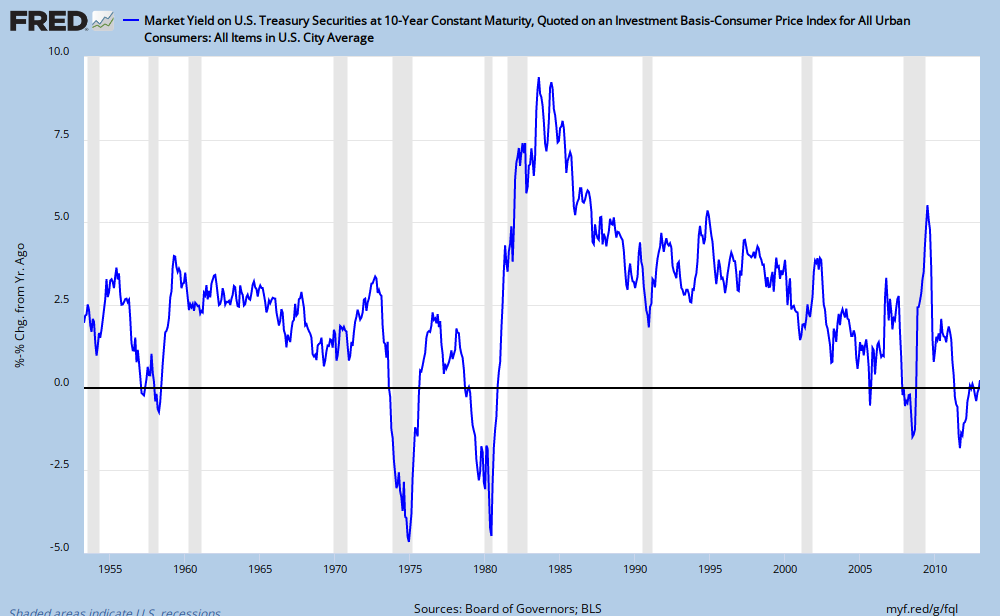

The inflation rate is key also to calculating the key economic growth rate, or GDP. By deflating the nominal GDP by the Government's 'official' 2 percent inflation rate, the U.S. economy shrank by some 0.5 percent in the last quarter of 2012. But if a higher, and I believe more accurate 4 percent inflation rate had been used, the U.S. economy would have been seen to regress by 2.5 percent. At that rate of inflation the paltry yields paid on bank deposits, and by 10-year U.S. Treasury bonds, are currently in deeply negative territory.

Regarding stock markets, the Dow passed 14,000 last week, to great acclaim. However, if discounted by the 'official' CPI of approximately two percent per year the Dow would have to reach about 15,400 to equal its October 9, 2007 high of 14,165. But discounted at a 4 percent per year inflation rate, the Dow would have to stand at more than 17,500 to pass its all time high in real terms.

Of course, the low inflation rate also provides the government with breathing room on the fiscal side. Low inflation keeps a limit on the increases that federal agencies are required to pay out to beneficiaries of programs such as Social Security. With the budget so tightly constrained by huge deficits, the low inflation data is essential to government planners.

More chicanery can be seen on the unemployment front. The government currently claims the unemployment rate to be at just 7.9 percent. But when calculating unemployment using the pre-Clinton methodology, SGS finds it to be around 22 percent. SGS does not exclude, as the government does now, all those who have left the workforce out of despair of finding a job, or those who who have accepted part time jobs in lieu of full time employment.

A world of politically manipulated 'official' statistics and misleading Government statements makes investment decisions more difficult. The result is that, despite falsely negative 'real' short-term interest rates and an abundance of debased cash, consumers and corporations continue to hoard cash. While the Dow has in fact surged in nominal terms, the leading U.S. equity funds continue to show significant outflows of investment funds. Rising stock prices have not convinced many Americans to get into the game. This should provide needed perspective on the current media euphoria.

John Browne is a Senior Economic Consultant to Euro Pacific Capital. Opinions expressed are those of the writer, and may or may not reflect those held by Euro Pacific Capital, or its CEO, Peter Schiff.