Lol,Yes, funny indeed. You still haven’t come up with any empirical data regarding actual tax revenues collected from top tier earners earners and bottom tier earners, but at least you’ve found something more than tax tables. And I’m giving you extra credit for sharing a link showing that despite dramatically higher marginal tax RATES, “the tax burden on high-income households today is only slightly lower than what these households faced in the 1950s.”

Right the rates have drop by 5.6% which means in 1950 the wealthy were paying 5.6% more than today. Glad we agree.The link also shows us that while the top bracket of tax tables has fallen from the 90% range in the 50s to the around 38% today, and effective rates have dipped only slightly between 1950 and 2014, the top earners still contribute the lions share of tax receipts collected by the US Treasury. That’s even more striking given this explanation of the 1950s average tax rates:

Note 4“The 42.0 percent tax rate on the top 1 percent takes into account all taxes levied by federal, state, and local governments, including: income, payroll, corporate, excise, property, and estate taxes. When we look at income taxes specifically, the top 1 percent of taxpayers paid an average effective rate of only 16.9 percent in income taxes during the 1950s.”

The data from Piketty, Saez, and Zucman is not divided among federal, state, and local taxes, so it is difficult to tell exactly how much the rich were paying in federal income taxes specifically during this period.

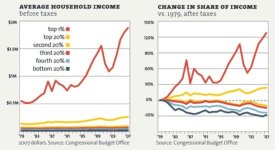

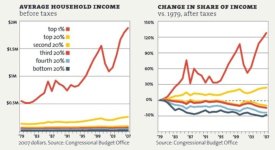

In 1950 the ratio of money the wealthy had to compared to the middle class was much smaller than today. Today the wealthy to middle class ratio is much larger. However the middle class itself is much large than it was in 1950, due to population, where as the wealthy ratio of the rich to middle class as people has not grown as much.As noted in the original post of this thread, the percentage of taxes collected from the top 1% represents 42% of the total. The top 5% today accounts for 63%.

The final paragraph in your link summarizes the point of this thread well:

Which is why, statistic can be twisted to fit any narrative. You are arguing the rich pay more today proportionally than they did in 1950, which is statistically correct. Yet the rich as a percentage of their income are paying less than they did in the 1950's by about 5.6 %.

A 5.6% increase of taxes from the 724 billionaires in the USA would be how much?