Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

US government rejected Keystone oil, which will now go to China...

- Thread starter coachdb18

- Start date

mustang200

Really Really Experienced

- Joined

- Jan 14, 2010

- Posts

- 359

Hey, he's Sucky Chucky, he can do dat!

U

unregistered

Guest

Sean Renaud

The West Coast Pop

- Joined

- Feb 5, 2004

- Posts

- 59,046

Cept the part where we all know Keystone is getting approved.

TexasWife25

Porn Buddy

- Joined

- Dec 6, 2011

- Posts

- 6,951

Cept the part where we all know Keystone is getting approved.

When it does, Im sure there will be 50 threads espousing it happened "Despite Obama and his crazy liberal environmentalists".

busybody..

Literotica Guru

- Joined

- Jul 28, 2002

- Posts

- 149,503

Cept the part where we all know Keystone is getting approved.

Yes, NIGGER, you are right....but what you left out

is that it was PARTLY approved

BUT NOT THE PART THAT CONNECTS TEH OIL TO THE PIPELINE

you might as well argue that

NIGGERZ are normal people while you are at it

Sean Renaud

The West Coast Pop

- Joined

- Feb 5, 2004

- Posts

- 59,046

When it does, Im sure there will be 50 threads espousing it happened "Despite Obama and his crazy liberal environmentalists".

Nah. It'll pass quietly with a few threads, probably started by Merc and Rob that get less than two pages of responses.

Thats one of the key differences between the left and right. The left do not crow about victories, we win and move onto the next battle.

trysail

Catch Me Who Can

- Joined

- Nov 8, 2005

- Posts

- 25,593

It was going there anyway. The whole pipeline argument is a farce. They just wanted to refine it in Huston instead of Canada or somewhere else.

Well, let's see if we can figure this out:

there's a whole lot of existing refining capacity in the U.S.. Refineries are shutting down right and left on the East Coast because they're being squeezed by the high cost of imported Brent crude.

Say, why don't we build a whole new set of refineries? What a really GREAT idea !!!!

badbabysitter

Vault Girl

- Joined

- Jul 6, 2002

- Posts

- 19,179

Wait till the derpheads here discover Canadian public opinion was so massively opposed to the Keystone Kops pipleline that the government has been forced to look at alternatives to a company that has a record of massive spills and really poor response to them

till then, just blame Obama...derp

till then, just blame Obama...derp

Sean Renaud

The West Coast Pop

- Joined

- Feb 5, 2004

- Posts

- 59,046

Wait till the derpheads here discover Canadian public opinion was so massively opposed to the Keystone Kops pipleline that the government has been forced to look at alternatives to a company that has a record of massive spills and really poor response to them

till then, just blame Obama...derp

Citation is needed that there was any Canadian opposal.

badbabysitter

Vault Girl

- Joined

- Jul 6, 2002

- Posts

- 19,179

TexasWife25

Porn Buddy

- Joined

- Dec 6, 2011

- Posts

- 6,951

Are you in favor of the Keystone XL pipeline which would carry crude oil from the Alberta oil sands to Houston, Texas?

38% in favor

49% opposed

13% don’t know

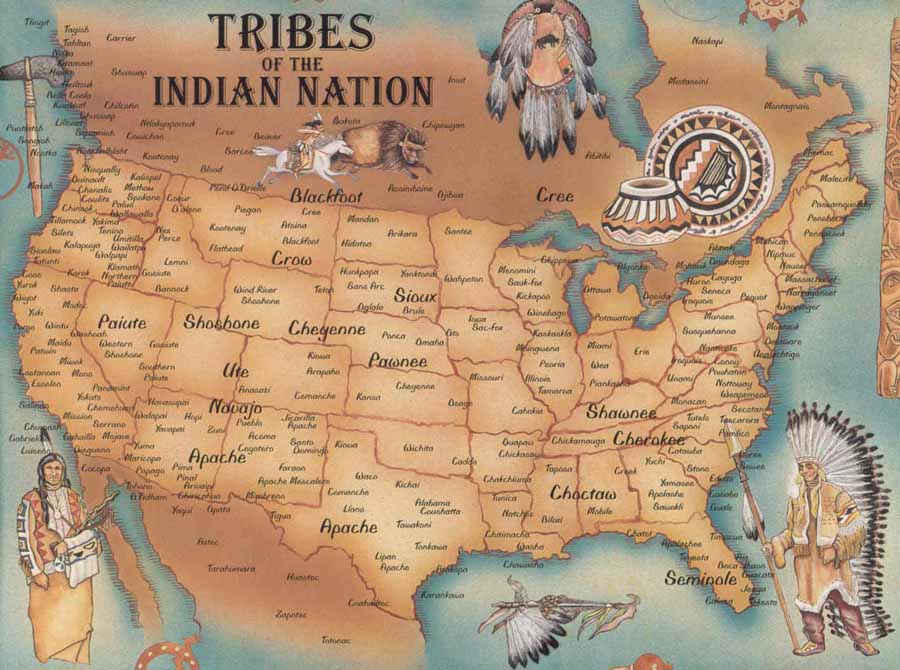

The reality is that a significant segment of the Canadian population and, in particular, First Nations communities with legitimate land claims, have the potential to significantly delay or otherwise impede the project. Public pressure is working and activists who oppose the pipeline will need to remain diligent, active and vocal to achieve their goals.

38% in favor

49% opposed

13% don’t know

The reality is that a significant segment of the Canadian population and, in particular, First Nations communities with legitimate land claims, have the potential to significantly delay or otherwise impede the project. Public pressure is working and activists who oppose the pipeline will need to remain diligent, active and vocal to achieve their goals.

rosco rathbone

1. f3e5 2. g4??

- Joined

- Aug 30, 2002

- Posts

- 42,430

IrezumiKiss

Literotica Guru

- Joined

- Feb 11, 2007

- Posts

- 74,174

Are you in favor of the Keystone XL pipeline which would carry crude oil from the Alberta oil sands to Houston, Texas?

38% in favor

49% opposed

13% don’t know

The reality is that a significant segment of the Canadian population and, in particular, First Nations communities with legitimate land claims, have the potential to significantly delay or otherwise impede the project. Public pressure is working and activists who oppose the pipeline will need to remain diligent, active and vocal to achieve their goals.

Who cares about the "First Nations?"

We're AMERICANS, dammit! We were born here and we were here first and deserve it and and...uh..uhhhh...

derp.

Sean Renaud

The West Coast Pop

- Joined

- Feb 5, 2004

- Posts

- 59,046

That's the price you pay for not having guns as big as the next guy. I'd love to sit here and feel bad for the Indians but that's been human history. I came. I saw. I conquered. It's unique to Americans that we add "I feel really bad about it."

trysail

Catch Me Who Can

- Joined

- Nov 8, 2005

- Posts

- 25,593

Wait till the derpheads here discover Canadian public opinion was so massively opposed to the Keystone Kops pipleline that the government has been forced to look at alternatives to a company that has a record of massive spills and really poor response to them

till then, just blame Obama...derp

badbabysitter

Vault Girl

- Joined

- Jul 6, 2002

- Posts

- 19,179

being an American you're clearly an expert on Canada

http://www.cbc.ca/news/canada/ottawa/story/2011/09/26/ottawa-oilsands-protest-parliament-hill.html

derpy derp derp

Sean Renaud

The West Coast Pop

- Joined

- Feb 5, 2004

- Posts

- 59,046

being an American you're clearly an expert on Canada

http://www.cbc.ca/news/canada/ottawa/story/2011/09/26/ottawa-oilsands-protest-parliament-hill.html

derpy derp derp

To be fair Canada are just Americans who have yet to taste freedom. We'll liberate you someday. We're sorry for the delay.

trysail

Catch Me Who Can

- Joined

- Nov 8, 2005

- Posts

- 25,593

http://www.bloomberg.com/news/2012-...ia-after-obama-rejects-keystone-pipeline.html

Canada Pledges to Sell Oil to Asia After Obama Keystone Permit Denial

By Theophilos Argitis and Jeremy Van Loon

January 19, 2012

Canada Pledges to Sell Oil to Asia After Obama Keystone Permit Denial

By Theophilos Argitis and Jeremy Van Loon

January 19, 2012

“Canada will continue to work to diversify its energy exports,” according to details provided by [Prime Minister Stephen] Harper’s office. Canadian Natural Resource Minister Joe Oliver said relying less on the U.S. would help strengthen the country’s “financial security.”

The “decision by the Obama administration underlines the importance of diversifying and expanding our markets, including the growing Asian market.”

“We have to have processes in Canada that come to a decision in a reasonable amount of time, and processes that cannot be hijacked,” Harper said...

The Keystone decision is the latest of several U.S. moves that have irked Canadian policy makers. Canada objected to “Buy American” provisions in the Obama administration’s $447 billion jobs bill that was blocked by Republicans in Congress, as well as the restoration of a $5.50 fee on Canadian travelers arriving in the U.S. by plane or ship.

Approval of Keystone is a “no-brainer,” Harper said.

http://www.bloomberg.com/news/2012-...ia-after-obama-rejects-keystone-pipeline.html

chillywilly2

AKA Bean

- Joined

- Mar 13, 2002

- Posts

- 16,674

Ummm...China is not buying the oil, they are buying the oilsands...the whole works.

1.9 billion worth of it

http://www.fortmcmurraytoday.com/ArticleDisplay.aspx?e=2242286&archive=true

and another for 4.6 billion

http://www.theglobeandmail.com/news...ands-is-about-more-than-money/article1534948/

1.9 billion worth of it

http://www.fortmcmurraytoday.com/ArticleDisplay.aspx?e=2242286&archive=true

and another for 4.6 billion

http://www.theglobeandmail.com/news...ands-is-about-more-than-money/article1534948/

Last edited:

TexasWife25

Porn Buddy

- Joined

- Dec 6, 2011

- Posts

- 6,951

http://www.bloomberg.com/news/2012-...ia-after-obama-rejects-keystone-pipeline.html

Canada Pledges to Sell Oil to Asia After Obama Keystone Permit Denial

By Theophilos Argitis and Jeremy Van Loon

January 19, 2012

Where in that does it say there is no Canadian opposition to the pipeline?

trysail

Catch Me Who Can

- Joined

- Nov 8, 2005

- Posts

- 25,593

http://www.bloomberg.com/news/2012-...exen-for-15-1-billion-to-expand-overseas.html

Cnooc Buys Nexen in China’s Top Overseas Acquisition

By Aibing Guo and Jeremy van Loon

July 23, 2012

Cnooc Buys Nexen in China’s Top Overseas Acquisition

By Aibing Guo and Jeremy van Loon

July 23, 2012

Cnooc Ltd. agreed to pay $15.1 billion in cash to acquire Canada’s Nexen Inc. in the biggest overseas takeover by a Chinese company.

China’s largest offshore oil and natural-gas explorer is paying $27.50 for each common share, a premium of 61 percent to Calgary-based Nexen’s closing price on July 20, according to its statement to the Hong Kong stock exchange yesterday. Nexen’s board recommended the deal to its shareholders...

***

...Nexen’s oil and gas assets include production platforms in the North Sea, the Gulf of Mexico and in Nigeria, as well as oil-sands reserves at Long Lake, Alberta, where it already produces crude in a joint venture with Cnooc. Those assets produced 207,000 barrels a day in the second quarter, which would boost the Chinese company’s output by about 20 percent. About 28 percent of Nexen’s current production is in Canada...

***

...The Nexen takeover comes as Canadian companies prepare to build new pipelines for transporting Canadian fossil fuel to Asia in an effort to reduce its dependence on the U.S. market, which has depressed prices for crude produced in Alberta’s oil sands and the Bakken in Saskatchewan.

“The political context in Canada is very good at the moment,” said Wenran Jiang, the Mactaggart Research Chair of the China Institute at the University of Alberta who advised the Alberta government on Chinese investment. “The Chinese have been careful to step up their involvement in Canada slowly. This isn’t coming out of nowhere.”

The transaction follows the Chinese company’s takeover of Nexen’s partner Opti Canada Inc. last year and the $19 billion bid for Unocal Corp. in 2005, which was blocked by political opposition in the U.S...

***

...Nexen has been searching for a new CEO since Marvin Romanow stepped down in January amid a slumping share price and missed production targets. Nexen’s market value had plunged 60 percent before yesterday from a high of C$43.45 in June 2008 as prices fell for natural gas, which accounts for about 20 percent of output. Production growth also slowed more than the company expected because of setbacks at projects in Canada’s oil sands and in the North Sea.

Barrel Value

Cnooc will add 900 million barrels of oil equivalent reserves at $19.94 per barrel through the deal, according to a document posted to the company’s website. Cnooc plans to boost output by as much as 2.7 percent this year to the equivalent of as much as 930,000 barrels of oil a day...

***

...Calgary will become one of Cnooc’s international headquarters and the operations hub for overseeing an additional $8 billion in assets in North and Central America. The Chinese company will also list its shares on the Toronto exchange, it said in the statement...

Canadian Appeal

Canada has become a fertile area for Chinese oil producers seeking to add oil and gas reserves to meet demand in the world’s largest energy-consuming country. After yesterday’s deal, Chinese companies will have spent about $49 billion on buying Canadian fields and oil companies... In contrast, they’ve laid down just $3.5 billion in U.S. acquisitions.

The deal will cement Cnooc’s position in Canada’s oil sands after last year’s $2.4 billion purchase of Opti Canada. When the transaction closes, Cnooc will own all of Long Lake, which plans to produce 72,000 barrels a day using steam to melt the tar-like oil out of the sands...

Reassuring Foreigners

Prime Minister Stephen Harper is seeking to assure foreign companies the country is open to investment...

http://www.bloomberg.com/news/2012-...exen-for-15-1-billion-to-expand-overseas.html

badbabysitter

Vault Girl

- Joined

- Jul 6, 2002

- Posts

- 19,179

Where in that does it say there is no Canadian opposition to the pipeline?

you won't find it, because tryfail thinks all Canadians share a hive-mind

meanwhile in the actual country known as Canada

http://www.huffingtonpost.ca/2012/0...vid-anderson_n_1720811.html?utm_hp_ref=canada

VANCOUVER - A former federal environment minister has taken aim at the proposed Northern Gateway pipeline, arguing the project is not in Canada's best interest and that Enbridge is the least trustworthy company to get the job done.

But David Anderson did not agree with his aboriginal and environmentalist counterparts' harsh words for the position taken by B.C.'s premier, instead saying Christy Clark is playing her cards right.

Last week, Clark walked out of talks at an annual premiers' meeting that included discussion about creating a national energy strategy, declaring Alberta must negotiate sharing economic benefits before she even considers supporting the project.

Both Clark and opponents of the pipeline agree Alberta stands to gain the lion's share of economic benefits while B.C. takes on most of the environmental risks.

But Grand Chief Stewart Phillip, who heads the Union of B.C. Indian Chiefs, says Clark needs to know that no amount of money will sway activists' opposition and that a fight against the project could include native blockades.

Federal environmental hearings are continuing for the $6-billion pipeline, which would flow crude from Alberta's oil sands to a port on B.C.'s west coast for export to Asia.

badbabysitter

Vault Girl

- Joined

- Jul 6, 2002

- Posts

- 19,179

derpy derp derp

mind you, this is the only popular thing she's done since Gordon Campbell resigned

http://www.huffingtonpost.ca/2012/0...ark_n_1710076.html?utm_hp_ref=canada-politics

HALIFAX - British Columbia Premier Christy Clark refused Friday to join her provincial counterparts in crafting a national energy strategy, insisting that a public feud over the Northern Gateway pipeline has to be resolved before she can proceed.

Clark stepped out of meetings at the Council of the Federation in Halifax to make the announcement as premiers tried to cobble together a pan-Canadian strategy on energy and before they broke for their final news conference.

She said she wouldn't endorse a deal before discussions take place with Ottawa and Alberta over how B.C. would be compensated for allowing the $6-billion pipeline to carry heavy oil to the B.C. coast to be loaded onto tankers bound for Asia.

"British Columbia will not be participating in any of those discussions until after we've seen some progress that our requirements for the shipment of heavy oil will be met," she told a hastily called news conference.

"It's not a national energy strategy if British Columbia hasn't signed on."

Clark and Alberta Premier Alison Redford have been locked in an intractable dispute over economic benefits associated with the megaproject proposed by Enbridge (TSX:ENB), with Clark saying the sides must talk before there can be any movement.

She said the two had a "very frank discussion" about it Friday morning, but didn't reveal details or if they planned on holding further talks on the matter.

Redford has said she sees no point in talking since the pipeline project is a private venture and British Columbia has to decide on its own how to proceed with trying to secure more revenue from it.

At the closing news conference, Redford said the lack of unanimity on a national energy plan wasn't something that concerned her.

"I don't think we should lament the fact that we're not all the way there yet," Redford said.

"I think we should actually celebrate a tremendous amount of success in that we had almost every premier in the country talking about the fact that we need to come together and talk about how to grow Canada's energy economy."

But after much talk going into the meeting of co-operation and the evolution of a pan-Canadian energy strategy, the premiers appeared to leave with little more than the creation of a working group of premiers that will build on a 2007 plan.

Still, the host of the annual meeting, Nova Scotia Premier Darrell Dexter, said he wasn't disappointed in the results of the gathering, which addressed health care, transfer payments, changes to employment insurance and aboriginal issues. He said the work of the council can continue despite the tussle between Alberta and B.C.

"I would like to see that work that we're doing as a bridge over any kind of division," he said.

Clark has said she decided to ask for an unspecified share of benefits from the Northern Gateway after doing analysis on the development, which will move bitumen from Alberta to the B.C. coast for shipment to Asia.

Her government has released five conditions she says need to be met before she can move forward with the pipeline. In addition to the demand for a greater portion of the economic benefits, they include the completion of an environmental review now underway, assurances that the "best" responses will be available for potential spills on land and at sea, and that aboriginal rights will be recognized.

Clark repeated her position that the province bears too much risk from oil spills at sea or on land, while receiving only eight per cent in tax benefits.

She added another wrinkle to the feud when she called on Ottawa on Wednesday to sit down with her and Redford to hash out the issue. Foreign Affairs Minister John Baird responded bluntly by questioning Clark's stance and reiterating the federal government's support for the project.

Redford has flatly dismissed Clark's position as one that would "fundamentally change Confederation" because it would mean new negotiations for projects throughout the country.

According to research in an application filed by Enbridge, 8.2 per cent of the Northern Gateway's projected $81 billion tax revenue would flow to B.C. over a 30-year period. That equates to $6.7 billion for B.C., while Ottawa is expected to receive $36 billion and Alberta would earn $32 billion.

Saskatchewan is expected to top the remainder of the provinces in terms of tax benefit, receiving about $4 billion.

Enbridge's proposed 1,177-kilometre twin line would carry heavy oil from Alberta across a vast swath of pristine B.C. wilderness and First Nations territory to a port at Kitimat, B.C., for shipment to Asia.

Last week, the company announced it will shore up $500 million in safety improvements.

Next year's Council of the Federation meeting will be held in Niagara-on-the-Lake, Ont.

mind you, this is the only popular thing she's done since Gordon Campbell resigned

http://www.huffingtonpost.ca/2012/0...ark_n_1710076.html?utm_hp_ref=canada-politics

HALIFAX - British Columbia Premier Christy Clark refused Friday to join her provincial counterparts in crafting a national energy strategy, insisting that a public feud over the Northern Gateway pipeline has to be resolved before she can proceed.

Clark stepped out of meetings at the Council of the Federation in Halifax to make the announcement as premiers tried to cobble together a pan-Canadian strategy on energy and before they broke for their final news conference.

She said she wouldn't endorse a deal before discussions take place with Ottawa and Alberta over how B.C. would be compensated for allowing the $6-billion pipeline to carry heavy oil to the B.C. coast to be loaded onto tankers bound for Asia.

"British Columbia will not be participating in any of those discussions until after we've seen some progress that our requirements for the shipment of heavy oil will be met," she told a hastily called news conference.

"It's not a national energy strategy if British Columbia hasn't signed on."

Clark and Alberta Premier Alison Redford have been locked in an intractable dispute over economic benefits associated with the megaproject proposed by Enbridge (TSX:ENB), with Clark saying the sides must talk before there can be any movement.

She said the two had a "very frank discussion" about it Friday morning, but didn't reveal details or if they planned on holding further talks on the matter.

Redford has said she sees no point in talking since the pipeline project is a private venture and British Columbia has to decide on its own how to proceed with trying to secure more revenue from it.

At the closing news conference, Redford said the lack of unanimity on a national energy plan wasn't something that concerned her.

"I don't think we should lament the fact that we're not all the way there yet," Redford said.

"I think we should actually celebrate a tremendous amount of success in that we had almost every premier in the country talking about the fact that we need to come together and talk about how to grow Canada's energy economy."

But after much talk going into the meeting of co-operation and the evolution of a pan-Canadian energy strategy, the premiers appeared to leave with little more than the creation of a working group of premiers that will build on a 2007 plan.

Still, the host of the annual meeting, Nova Scotia Premier Darrell Dexter, said he wasn't disappointed in the results of the gathering, which addressed health care, transfer payments, changes to employment insurance and aboriginal issues. He said the work of the council can continue despite the tussle between Alberta and B.C.

"I would like to see that work that we're doing as a bridge over any kind of division," he said.

Clark has said she decided to ask for an unspecified share of benefits from the Northern Gateway after doing analysis on the development, which will move bitumen from Alberta to the B.C. coast for shipment to Asia.

Her government has released five conditions she says need to be met before she can move forward with the pipeline. In addition to the demand for a greater portion of the economic benefits, they include the completion of an environmental review now underway, assurances that the "best" responses will be available for potential spills on land and at sea, and that aboriginal rights will be recognized.

Clark repeated her position that the province bears too much risk from oil spills at sea or on land, while receiving only eight per cent in tax benefits.

She added another wrinkle to the feud when she called on Ottawa on Wednesday to sit down with her and Redford to hash out the issue. Foreign Affairs Minister John Baird responded bluntly by questioning Clark's stance and reiterating the federal government's support for the project.

Redford has flatly dismissed Clark's position as one that would "fundamentally change Confederation" because it would mean new negotiations for projects throughout the country.

According to research in an application filed by Enbridge, 8.2 per cent of the Northern Gateway's projected $81 billion tax revenue would flow to B.C. over a 30-year period. That equates to $6.7 billion for B.C., while Ottawa is expected to receive $36 billion and Alberta would earn $32 billion.

Saskatchewan is expected to top the remainder of the provinces in terms of tax benefit, receiving about $4 billion.

Enbridge's proposed 1,177-kilometre twin line would carry heavy oil from Alberta across a vast swath of pristine B.C. wilderness and First Nations territory to a port at Kitimat, B.C., for shipment to Asia.

Last week, the company announced it will shore up $500 million in safety improvements.

Next year's Council of the Federation meeting will be held in Niagara-on-the-Lake, Ont.

Similar threads

- Replies

- 0

- Views

- 399

- Replies

- 1

- Views

- 228

- Replies

- 59

- Views

- 4K

Share: