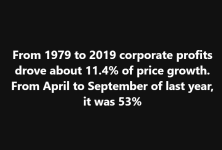

Are Markups Driving the Ups and Downs of Inflation?

Federal Reserve Bank of San Francisco, May 13, 2024

“How much impact have price markups for goods and services had on the recent surge and the subsequent decline of inflation? Since 2021, markups have risen substantially in a few industries such as motor vehicles and petroleum. However, aggregate markups—which are more relevant for overall inflation—have generally remained flat, in line with previous economic recoveries over the past three decades. These patterns suggest that markup fluctuations have not been a main driver of the ups and downs of inflation during the post-pandemic recovery.”

https://www.frbsf.org/research-and-...re-markups-driving-ups-and-downs-of-inflation

More gaslighting from BabyBoobs.

That article is an economic letter - an opinion piece.

BabyBoobs selected quote omits that little relevant tidbit.

Here - let me help:

“Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.”

Hope that ^ helps.