Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Charlie Kirk Shot

- Thread starter eric_erosfan

- Start date

eric_erosfan

Rationalist

- Joined

- Feb 19, 2023

- Posts

- 3,925

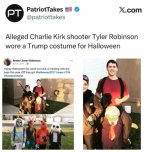

The kid is from a MAGA family. Curious.They got him. In custody.

eric_erosfan

Rationalist

- Joined

- Feb 19, 2023

- Posts

- 3,925

Something is not adding up. All of the pictures show a normal American white kid who had a love of guns and military. MAGA parents. The only thing I see is potentially younger brothers with challenges.

ChinoMoreno

Literotica Guru

- Joined

- Oct 26, 2017

- Posts

- 2,313

eric_erosfan

Rationalist

- Joined

- Feb 19, 2023

- Posts

- 3,925

Some folks surmising the kid is a groyper. Never heard of it. Apparently alt-right Nick Fuentes followers? So I've never heard of Nick Fuentes either. Lol.

eric_erosfan

Rationalist

- Joined

- Feb 19, 2023

- Posts

- 3,925

A lot of flabbergasted MAGAs on TwitterX. They were prepared to see a brown-skinned illegal or green-haired trans.

Instead they got their own golden boy son.

Instead they got their own golden boy son.

Also:

Remember when "the right" lost their collective shit because President Biden’s administration simply asked big tech and social media platforms to make some effort to curb misinformation???

Hypocrisy, thy name is "conservatives"…

We. Told. Them. So.

Baztrachian

Ars est celare artem

- Joined

- Oct 5, 2019

- Posts

- 2,284

eric_erosfan

Rationalist

- Joined

- Feb 19, 2023

- Posts

- 3,925

Something not adding up.

The new footage shows Tyler Robinson pulling into the campus in a gray Dodge Challenger at around 8:29 a.m. MT. He's seen "wearing a plain maroon T-shirt, light-colored shorts, a black hat with a white logo and light colored shoes," Cox said, which was consistent with what Robinson was wearing when confronted by investigators on Thursday evening.

Umm...

The new footage shows Tyler Robinson pulling into the campus in a gray Dodge Challenger at around 8:29 a.m. MT. He's seen "wearing a plain maroon T-shirt, light-colored shorts, a black hat with a white logo and light colored shoes," Cox said, which was consistent with what Robinson was wearing when confronted by investigators on Thursday evening.

Umm...

Baztrachian

Ars est celare artem

- Joined

- Oct 5, 2019

- Posts

- 2,284

During the Great Depression we taxed the rich and became prosperous.

The closest approximation to democratic socialism is Scandinavian Social Democracy. By criteria I value it works better than the American system of casino capitalism, where the odds favor the house.

During the Great Depression the Democrats stole everyone's gold, stole a lot of land that they transferred to their wealthy cronies, and then when the war drums in Europe started pounding the Democrats (over the objections of the Republicans) made billions by selling arms to the British and the French. Which eventually got the US involved in the war with Germany.

World War Two and the government borrowing and spending hundreds of billions from the banking cartel at the ill-named "Federal Reserve" created an economic bubble that burst at the end of the war effectively causing a recessionary rebound that persisted into the 1960's.

The confiscatory 98% tax rate on wealth ironically caused a flight of wealth from the US to Germany and Japan, contributing to their rise as the economic powerhouses of the second half of the 20th Century.

It's no doubt lost on you that the single largest tax cut as a percentage of GDP took place when John Kennedy led the Democrats to slash taxes in a bill that was passed in 1964.

https://en.wikipedia.org/wiki/Revenue_Act_of_1964

Last edited:

RobDownSouth

BoycotDivestSanctio

- Joined

- Apr 13, 2002

- Posts

- 78,478

The MAGA high command has issued a Defcon 1 alert to paint the shooter as "definitely not one of us"

so they were forced to dredge up right wing hatemonger Joey Mannarino (aka "Joey Buttstuff" "I will not have vaginal sex with my Ukranian mail-order bride until the Ukranian forces push the Russians out").

Joey blames....."college indoctrination"

Pay no attention to the fact that the shooter's birthing vessel was a Wat_Tyler class ammosexual....

so they were forced to dredge up right wing hatemonger Joey Mannarino (aka "Joey Buttstuff" "I will not have vaginal sex with my Ukranian mail-order bride until the Ukranian forces push the Russians out").

Joey blames....."college indoctrination"

Pay no attention to the fact that the shooter's birthing vessel was a Wat_Tyler class ammosexual....

RobDownSouth

BoycotDivestSanctio

- Joined

- Apr 13, 2002

- Posts

- 78,478

This gets my vote for the most ignorant comment of the month (non-Derpy division)The confiscatory 98% tax rate on wealth ironically caused a flight of wealth from the US to Germany and Japan, contributing to their rise as the economic powerhouses of the second half of the 20th Century.

Baztrachian

Ars est celare artem

- Joined

- Oct 5, 2019

- Posts

- 2,284

This gets my vote for the most ignorant comment of the month (non-Derpy division)

I'm ignorant because I know the history of this period and you don't?

https://www.cambridge.org/core/jour...omic-miracle/9C7CC6A85CE125290BAD2735B09A882A

The above paper is probably wasted on you but if you do read it you'll note that the US extended privately-backed loans to Japan and Japanese corporations (also known as investments) in excess of those already funded under the Marshall Plan.

The US encouraged these loans by exempting them from capital gains taxes, a practice that still persists.

Back in 1988 I invested a whopping $1000 into a fund that spurred development in the financial sector of the Republic of the Marshall Islands.

It paid 27% annualized simple interest and it was fully exempt from capital gains and, like a muni bond, it was also exempt from Federal and state income tax.

I am still letting that investment ride and today it is worth about $41,000.

And when I cash out it is tax free.

So mock me all you want. My assets are all postive numbers. Are yours?

BrightShinyGirl

Abusive Little Bitch

- Joined

- Nov 22, 2013

- Posts

- 8,496

Tyler Robinson scratched a video game combo onto one of the shells the investigators found. It was a Helldivers 2 reference to “calling in the big gun”. He also scratched “if you can read this … you’re gay”.

https://www.theverge.com/politics/7...-with-a-helldivers-combo-and-a-furry-sex-meme

https://www.theverge.com/politics/7...-with-a-helldivers-combo-and-a-furry-sex-meme

You don't seem to know that Nixon flipped the parties with the Voting Rights Act (and other policies).I'm ignorant because I know the history of this period and you don't?

https://www.cambridge.org/core/jour...omic-miracle/9C7CC6A85CE125290BAD2735B09A882A

The above paper is probably wasted on you but if you do read it you'll note that the US extended privately-backed loans to Japan and Japanese corporations (also known as investments) in excess of those already funded under the Marshall Plan.

The US encouraged these loans by exempting them from capital gains taxes, a practice that still persists.

Back in 1988 I invested a whopping $1000 into a fund that spurred development in the financial sector of the Republic of the Marshall Islands.

It paid 27% annualized simple interest and it was fully exempt from capital gains and, like a muni bond, it was also exempt from Federal and state income tax.

I am still letting that investment ride and today it is worth about $41,000.

And when I cash out it is tax free.

So mock me all you want. My assets are all postive numbers. Are yours?

The guys who waved Confederate flags and fought to keep slaves were not New York Liberals.

Baztrachian

Ars est celare artem

- Joined

- Oct 5, 2019

- Posts

- 2,284

Tyler Robinson scratched a video game combo onto one of the shells the investigators found. It was a Helldivers 2 reference to “calling in the big gun”. He also scratched “if you can read this … you’re gay”.

https://www.theverge.com/politics/7...-with-a-helldivers-combo-and-a-furry-sex-meme

Shit. Al Gore's fucking wife will come along now and demand that we ban video games.

the fact parties can change philosophically is beyond the understanding of dumb Fascists. As is many many things.You don't seem to know that Nixon flipped the parties with the Voting Rights Act (and other policies).

The guys who waved Confederate flags and fought to keep slaves were not New York Liberals.

eric_erosfan

Rationalist

- Joined

- Feb 19, 2023

- Posts

- 3,925

That would be about 10.5% if you never touched it.I'm ignorant because I know the history of this period and you don't?

https://www.cambridge.org/core/jour...omic-miracle/9C7CC6A85CE125290BAD2735B09A882A

The above paper is probably wasted on you but if you do read it you'll note that the US extended privately-backed loans to Japan and Japanese corporations (also known as investments) in excess of those already funded under the Marshall Plan.

The US encouraged these loans by exempting them from capital gains taxes, a practice that still persists.

Back in 1988 I invested a whopping $1000 into a fund that spurred development in the financial sector of the Republic of the Marshall Islands.

It paid 27% annualized simple interest and it was fully exempt from capital gains and, like a muni bond, it was also exempt from Federal and state income tax.

I am still letting that investment ride and today it is worth about $41,000.

And when I cash out it is tax free.

So mock me all you want. My assets are all postive numbers. Are yours?

DeluxAuto

AntiSocial Extrovert

- Joined

- Dec 16, 2010

- Posts

- 22,179

So you are a member of a hate group, Three Percenters, and spent your child's life training him to be anti-government, an anarchist, to resist fascism and how to be a sniper (lots of images online of him shooting long guns - not hunting). He just didn't get the memo that MAGA fascism is the good kind of fascism. Don't you dare try and claim he was radicalized by the left. He did exactly what you trained him to do.

RobDownSouth

BoycotDivestSanctio

- Joined

- Apr 13, 2002

- Posts

- 78,478

Claiming captial flight from the United States to Japan as a result of high tax rates is nonsense.I'm ignorant because I know the history of this period and you don't?

https://www.cambridge.org/core/jour...omic-miracle/9C7CC6A85CE125290BAD2735B09A882A

The above paper is probably wasted on you but if you do read it you'll note that the US extended privately-backed loans to Japan and Japanese corporations (also known as investments) in excess of those already funded under the Marshall Plan.

The US encouraged these loans by exempting them from capital gains taxes, a practice that still persists.

<anecdata snip>

You may be too young to remember, but back in the late 1950s there was this thing called "Communism" and the USA did everything they could to keep the Japanese from falling into the "sphere of influence" of either the Communist China and Soviet Union.

The "research paper" you linked to is quite a pip.

The authors created an imaginary "synthetic Japan" to determine what might have happened had US investment not increased. Complete fiction, designed solely to buttress a predetermined outcome.

Like most mouthbreathers here, you post specious links and hope 'n pray people won't read them.

I did read them though, and laugh at your pathetic "evidence" to prove your spurious point.

rgraham666

Literotica Guru

- Joined

- Feb 19, 2004

- Posts

- 43,717

My final take on Mr. Kirk's death.

I waste as much sorrow on him as I would any drug dealer. None at all.

I am sorry for his wife's loss and especially sorry for his children.

Him? The world is better off without him spreading the drugs fear, anger, and hatred.

I waste as much sorrow on him as I would any drug dealer. None at all.

I am sorry for his wife's loss and especially sorry for his children.

Him? The world is better off without him spreading the drugs fear, anger, and hatred.

Similar threads

- Replies

- 578

- Views

- 9K

- Replies

- 52

- Views

- 860

- Replies

- 24

- Views

- 320

- Replies

- 10

- Views

- 242

Share: