DeluxAuto

AntiSocial Extrovert

Joined Dec 16, 2010 Posts 20,826

You are ignoring content by this member. Show ignored content

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

LUNATICBaghdad Bob, meet Baghdad Bessent!

At least HB is not disagreeing with the numbers. The sharp decline started under Biden.LUNATIC

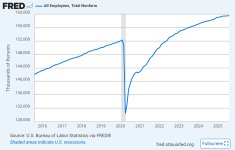

The processes need to be reviewed to find the gaps.Here is a contextual visual. It shows when the decline started around 2022 or 2023.

View attachment 2563282

The Big Beautiful Bill increased your taxes?President Pedo is boasting about how many jobs he's cut, and how much he's increased taxes.

MAGAts live in a bizarre world.

Tariffs are taxes. They are types of taxes, like Ford is a type of car.The Big Beautiful Bill increased your taxes?

Here is a contextual visual. It shows when the decline started around 2022 or 2023.

View attachment 2563282

Yes, tariffs are a tax levied on businesses that import goods. Businesses also pay corporate income taxes.Tariffs are taxes. They are types of taxes, like Ford is a type of car.

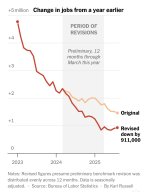

Maybe this chart published in the NYT today will help you. Like the previous chart I shared, source data comes from BLS. As you can see, things started looking bad in 2023.JFC, you can’t even understand a graph.

First of all, that graph is moronic. It’s graphing the total 12 month revision as a data point for one quarter.

The fact that it is plotting revisions is dumb and pointless in itself. You’re pretending it plots job creation, but it doesn’t. It’s just the revisions of the job estimates.

Here’s an actually informative graph of employment in the US. The flatlining of growth didn’t happen until 2025.

View attachment 2563293

Did President Biden ever boast about raising taxes like Trump does?Yes, tariffs are a tax levied on businesses that import goods. Businesses also pay corporate income taxes.

Have your federal taxes increased this year?

Since you’ve chosen to avoid the question I asked you, I’lll answer it for you. I’ll also answer the question you asked me.Did President Biden ever boast about raising taxes like Trump does?

That depends on whether tariffs have impacted the price of goods they purchase. That may mean their federal taxes have significantly risen or not at all.Since you’ve chosen to avoid the question I asked you, I’lll answer it for you. I’ll also answer the question you asked me.

Your tax federal burden has not increased under President Trump. You’re getting a tax cut effective in 2026.

Biden did raise tariffs, but I don’t know if he boasted about it. He promised to raise income taxes on businesses and people in the top marginal tax bracket but he never delivered on that promise.

Maybe this chart published in the NYT today will help you. Like the previous chart I shared, source data comes from BLS. As you can see, things started looking bad in 2023.

View attachment 2563296

Your tax federal burden has not increased under President Trump.

Biden did raise tariffs, but I don’t know if he boasted about it.

The graph shows the change in jobs from a year earlier for the period between 2023 and March of this year. The shaded area shows the revisions for the last 12 months of that period.You still don’t understand your own graphs.

Rather than the continuing job growth shown in that graph, it’s possible (likely?) that employment actually declined in 2025 when Trump had his tariff tantrums.

- The latest revision says absolutely nothing about 2023 or early 2024. Pretending that the 3 million jobs created in 2023 was bad is dumb.

- Read the note at the bottom of the graph. It presumes the downward revision was spread evenly over the 12 months. In fact the revision may impact 2025 more than 2024. We don’t know because the monthly numbers weren’t released.

tariffs are taxes on the consumer.Since you’ve chosen to avoid the question I asked you, I’lll answer it for you. I’ll also answer the question you asked me.

Your tax federal burden has not increased under President Trump. You’re getting a tax cut effective in 2026.

Biden did raise tariffs, but I don’t know if he boasted about it. He promised to raise income taxes on businesses and people in the top marginal tax bracket but he never delivered on that promise.

ICYMI, the president signed tax legislation this year extending the individual marginal income tax rates that were due to expire at the end of the year. There are other tax cut provisions in the legislation as well.Nonsense. The TrumpTariffs are the largest tax increase on Americans since the 1960s.

Trump boasted about his TrumpTariffs. He said they are “making us rich”. Classic doublespeak.

Tariffs are a tax on imported goods. They can be absorbed by businesses, passed on to consumers, or split in one form or the other. In some cases, consumers can avoid products subjected to tariffs by purchasing domestic products. Certainly not the case for products that have a high percentage of steel and aluminum, but absolutely true with many grocery products.tariffs are taxes on the consumer.

the end.

i will let krogers know that i will only be paying for my share of the tariffs next time i go grocery shopping.Tariffs are a tax on imported goods. They can be absorbed by businesses, passed on to consumers, or split in one form or the other. In some cases, consumers can avoid products subjected to tariffs by purchasing domestic products. Certainly not the case for products that have a high percentage of steel and aluminum, but absolutely true with many grocery products.

Btw, corporate income taxes are often passed on to the consumer as well. It’s one of the reasons Obama proposed lowering in from 35% to 28% back in 2012. He never got it done. Fortunately Trump cut it in 2017, from 35% to 21%.

What you could do at Krogers is substitute products. But you’ll most likely be saving thousands on your federal taxes thanks to the legislation Trump signed this year. It will more than offset any small tariff impact that might show up on your grocery bill.i will let krogers know that i will only be paying for my share of the tariffs next time i go grocery shopping.