Man people who vote for their demise out of party loyalty are a trip!

I laugh real hard at common MAGAts for that very reason.

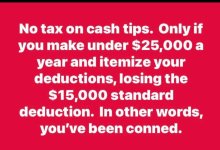

I laugh even harder at those on "the left" ("the left" allegedly being Muslims, the LGBTQ community, Hispanics, black people, etc) who voted for DonOld & the MAGAt republicans (or didn’t vote for Kamala & the Democrats) because of Gaza, economic & social disparities, the fucked up immigration system, and because "Democrats are just as bad as republicans":

HOW DOES "THE LEFT"l LIKE THINGS NOW???

HAPPY???

We. Told. Them. So.