heathrowinneo

Literotica Guru

- Joined

- Jun 1, 2006

- Posts

- 20,011

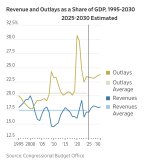

That may be but without increased revenues the US will face additional scrutiny and potential downgrades. Tariffs provide some tax revenue but not enough for the proposed budget.Tax receipts as a percentage of GDP has been consistently been about 17% since the 60s. Spending has grown as a percentage of GDP.

Funding social security is a simpler solution but a bitter pill for politicians, raise the payroll limit beyond $162k.

Medicare/Medicaid funding cuts will put more pressure on states and another bitter pill for politicians.

The proposed budget just heaps more debt on the country and kicks the can down the road.