Karen Kraft

29

- Joined

- May 18, 2002

- Posts

- 36,253

Soon, Bam-Bam, the "fuck you" man, will bring us yet another hystorical moment:

The hyperinflation of 1914-1923 will be repeated 100 years later (that's 2014-2023 for those of you who majored in non-scientific studies).

"Uh, we inherited deficit spending when we came into office. Bush did it; wasn't me."

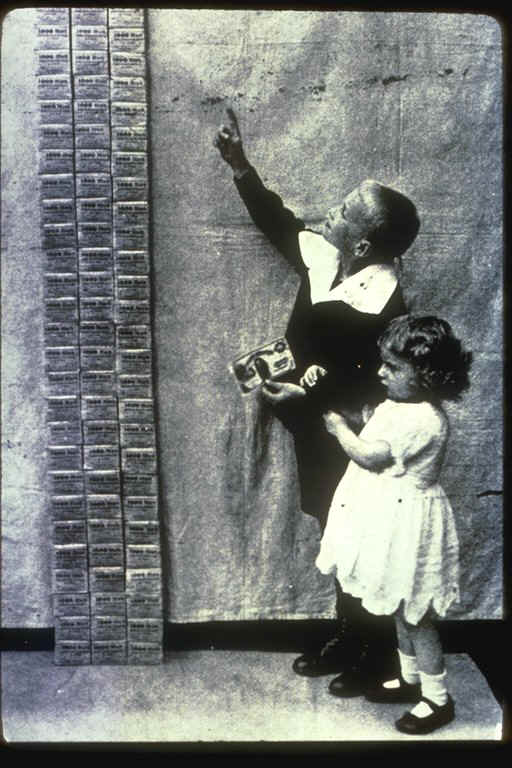

Oh look, Contweaka, we almost have enough

for Pop's doctor visit co-pay today!

The hyperinflation of 1914-1923 will be repeated 100 years later (that's 2014-2023 for those of you who majored in non-scientific studies).

"Uh, we inherited deficit spending when we came into office. Bush did it; wasn't me."

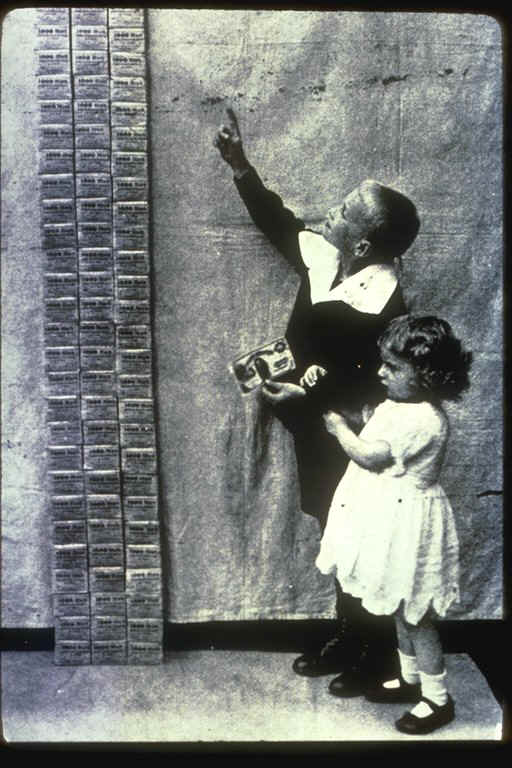

Oh look, Contweaka, we almost have enough

for Pop's doctor visit co-pay today!