JohnnySavage

Literotica Guru

- Joined

- Aug 25, 2008

- Posts

- 44,472

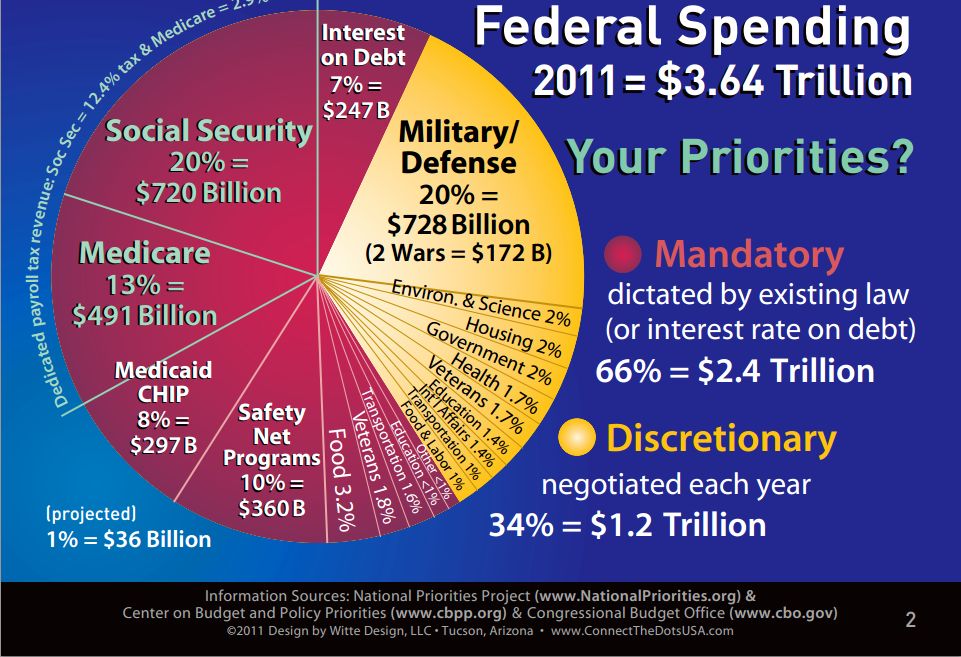

The debt ceiling is a meaningless and artificial construct that just provides good political theater - because Congress authorizes spending without respect to a debt limit.

Then every six months or a year, the Treasury says, "We don't have any money to pay for the authorized spending."

Then the party in power says, "We have to raise the limit to pay for things already bought!"

Then the debt ceiling is raised, and new spending is authorized.

It's circular.

Congress's spending should be tied to paying the bill.

Then every six months or a year, the Treasury says, "We don't have any money to pay for the authorized spending."

Then the party in power says, "We have to raise the limit to pay for things already bought!"

Then the debt ceiling is raised, and new spending is authorized.

It's circular.

Congress's spending should be tied to paying the bill.