JohnEngelman

Virgin

- Joined

- Jan 8, 2022

- Posts

- 3,768

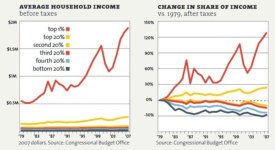

In his title to Econoclasts: The Rebels Who Sparked the Supply-Side Revolution and Restored American Prosperity Brian Domitrovic claims that supply-side economics “restored American prosperity.” Prosperity for whom? According to Congressional Budget Office numbers for after tax income, in 1980 the richest fifth of our country had eight times the income of the poorest fifth. By 1989 the ratio was more than twenty to one. According again to the CBO, the greatest increase in after tax income went to the best paid one percent of the United States. After tax income for the bottom 60% declined.

In the first chapter of Econoclasts Brian Domitrovic wrote, “The economic results that supply-siders foresaw at the time [the late 1970’s to 1980] did in fact come to pass.”

Not really. During his 1980 debate with President Carter Reagan, who had spent much of his political career condemning deficit spending, claimed that his economic policies would balance the budget by 1983 “If not sooner.”

In 1980 the budget deficit was $74 billion. In 1983 it had grown to $208 billion.

https://www.thebalance.com/us-deficit-by-year-3306306

By the time President Reagan left office the national debt had grown from approximately $907,701,000,000.00 to more precisely $2,602,337,712,041.16.

https://www.thestreet.com/politics/national-debt-year-by-year-14876008

In Chapter Five Domitrovic wrote, “the inflation crisis was in full swing before the OPEC shock of late 1973…In the 12 months before the OPEC announcement consumer prices in the United States increased by 8 percent.”

In October the Organization of the Petroleum Exporting Countries announced that it was raising the price of its oil to punish the United States for helping Israel in the Yom Kipper War.

In October 1972 the inflation rate was 3.7%. The average for 1972 was 3.2% The average for 1973 was 4.4%. The average for 1974 was 11.0%.

https://www.usinflationcalculator.com/inflation/historical-inflation-rates/

Domitrovic sees the rise in the price of petroleum as a result of the stagflation of the 1970’s, because he wants to blame the government and Keynesian economics. Let’s see which came first.

In 1972 the price of a barrel of petroleum was $3.60. In 1973 it was 4.75. In 1974 it was $9.35.

https://inflationdata.com/articles/inflation-adjusted-prices/historical-crude-oil-prices-table/

In 1972 the inflation rate was 3.2%. In 1973 it was 6.2%. In 1974 it was 11.0%.

https://inflationdata.com/articles/inflation-adjusted-prices/historical-crude-oil-prices-table/

In 1972 the unemployment rate was 5.2%. In 1973 it was 4.9%. In 1974 it was 7.2%.

https://www.thebalance.com/unemployment-rate-by-year-3305506

When we keep in mind that the OPEC Oil Embargo did not begin until October 1973, it should be clear that the increase in the price of oil preceded the increase in inflation and unemployment. The rise in the price of petroleum was not a result of the stagflation; it was the cause.

https://inflationdata.com/articles/inflation-adjusted-prices/historical-crude-oil-prices-table/

Republicans like to blame Keynesian economic policies for the stagflation of the 1970’s. For the four decades from the inauguration of President Roosevelt in 1933 to 1973, Keynesian policies resulted in reasonably steady job growth, growth in the per capita gross domestic product (GDP), and milder recessions. Republicans never liked Keynesian policies because they shifted wealth, power, and prestige from the business community to the government.

Republicans do not want blame the increase in the price of petroleum that followed the OPEC Oil Embargo, and the Iranian Revolution of 1979 for the stagflation because they do not want to acknowledge that foreigners they dislike had considerable control over the U.S. economy.

Keynesian economic policies were designed to fight the Great Depression. During the 1930’s the problem was not inflation, but deflation. Moreover, Keynesian economic policies were not designed to respond to a shortage in a natural resource essential to the U.S. economy.

In the first chapter of Econoclasts Brian Domitrovic wrote, “The economic results that supply-siders foresaw at the time [the late 1970’s to 1980] did in fact come to pass.”

Not really. During his 1980 debate with President Carter Reagan, who had spent much of his political career condemning deficit spending, claimed that his economic policies would balance the budget by 1983 “If not sooner.”

In 1980 the budget deficit was $74 billion. In 1983 it had grown to $208 billion.

https://www.thebalance.com/us-deficit-by-year-3306306

By the time President Reagan left office the national debt had grown from approximately $907,701,000,000.00 to more precisely $2,602,337,712,041.16.

https://www.thestreet.com/politics/national-debt-year-by-year-14876008

In Chapter Five Domitrovic wrote, “the inflation crisis was in full swing before the OPEC shock of late 1973…In the 12 months before the OPEC announcement consumer prices in the United States increased by 8 percent.”

In October the Organization of the Petroleum Exporting Countries announced that it was raising the price of its oil to punish the United States for helping Israel in the Yom Kipper War.

In October 1972 the inflation rate was 3.7%. The average for 1972 was 3.2% The average for 1973 was 4.4%. The average for 1974 was 11.0%.

https://www.usinflationcalculator.com/inflation/historical-inflation-rates/

Domitrovic sees the rise in the price of petroleum as a result of the stagflation of the 1970’s, because he wants to blame the government and Keynesian economics. Let’s see which came first.

In 1972 the price of a barrel of petroleum was $3.60. In 1973 it was 4.75. In 1974 it was $9.35.

https://inflationdata.com/articles/inflation-adjusted-prices/historical-crude-oil-prices-table/

In 1972 the inflation rate was 3.2%. In 1973 it was 6.2%. In 1974 it was 11.0%.

https://inflationdata.com/articles/inflation-adjusted-prices/historical-crude-oil-prices-table/

In 1972 the unemployment rate was 5.2%. In 1973 it was 4.9%. In 1974 it was 7.2%.

https://www.thebalance.com/unemployment-rate-by-year-3305506

When we keep in mind that the OPEC Oil Embargo did not begin until October 1973, it should be clear that the increase in the price of oil preceded the increase in inflation and unemployment. The rise in the price of petroleum was not a result of the stagflation; it was the cause.

https://inflationdata.com/articles/inflation-adjusted-prices/historical-crude-oil-prices-table/

Republicans like to blame Keynesian economic policies for the stagflation of the 1970’s. For the four decades from the inauguration of President Roosevelt in 1933 to 1973, Keynesian policies resulted in reasonably steady job growth, growth in the per capita gross domestic product (GDP), and milder recessions. Republicans never liked Keynesian policies because they shifted wealth, power, and prestige from the business community to the government.

Republicans do not want blame the increase in the price of petroleum that followed the OPEC Oil Embargo, and the Iranian Revolution of 1979 for the stagflation because they do not want to acknowledge that foreigners they dislike had considerable control over the U.S. economy.

Keynesian economic policies were designed to fight the Great Depression. During the 1930’s the problem was not inflation, but deflation. Moreover, Keynesian economic policies were not designed to respond to a shortage in a natural resource essential to the U.S. economy.