RobDownSouth

BoycotDivestSanctio

- Joined

- Apr 13, 2002

- Posts

- 78,311

That's his secret, Cap. He's always angry.You sound very angry!

<Hulk mode enabled>

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

That's his secret, Cap. He's always angry.You sound very angry!

ICE's military budget now exceeds that of five foreign countries. Combined.We just authorized trillions for ICE. It seems that with all that money, we could have fed the poor and provided shelter for homeless veterans. My $0.02.

Yet another call for democrat violence.Another RepubliKKKan.

Democrats told to "get shot" for the anti-Trump resistance

Yet another call for democrat violence.

I reloaded a couple hundred rounds this past weekend.................just in case they're serious.

Learn to read, shit for brains.Yet another call for democrat violence.

I reloaded a couple hundred rounds this past weekend.................just in case they're serious.

Someone else shut off his access to medical care.Learn to read, shit for brains.

Load up! We'll shut off your power and access to medical care.

Ah, the exquisite irony of someone who uses "GO FUCK YOURSELF" as his typical final debate reply lecturing others on debate protocol.

I live in Washington too. This state is a friggin mess.Here in Washington State, we are NOT celebrating lower gas prices. Ours just went up another 6 cents a gallon, to an average of $4.41 a gallon. So many electric cars have cut into our department of transportation and their over inflated salaries.

Actually, you know about the tax making the gas $4.40?I live in Washington too. This state is a friggin mess.

Yup. They raised the gas tax 6 cents a gallon and also put in a 2% annual increase.Actually, you know about the tax making the gas $4.40?

It is the new state transportation budget.Yup. They raised the gas tax 6 cents a gallon and also put in a 2% annual increase.

They’re taxing us to death and still can’t balance the damn budget.It is the new state transportation budget.

He'd be dead within two weeks, both him and his elk (sic).Learn to read, shit for brains.

Load up! We'll shut off your power and access to medical care.

You could easily avoid the tax by not driving.They’re taxing us to death and still can’t balance the damn budget.

They’re taxing us to death and still can’t balance the damn budget.

Such an angry crippled fag you are.Let me be perfectly clear; go fuck yourself sideways, you asshole.

Why are tax cuts a good idea when the national debt is higher than the gross domestic product?So many things to celebrate this weekend! The anniversary of Greatest Country in World History, passage of major tax cut and spending reform legislation today, the spectacular performance of US military might in Iran, a strong economy and rising stock market, low gas prices, a string of excellent Supreme Court decisions, and now this!

God Bless the USA and the PB Board

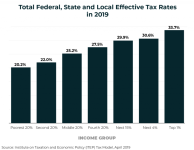

The OBBB prevented a massive tax hike that was scheduled to kick in next year.Why are tax cuts a good idea when the national debt is higher than the gross domestic product?View attachment 2568405

The OBBB prevented a massive tax hike that was scheduled to kick in next year.

If higher income taxes are a good thing, is the tax revenue being collected from the tariff taxes a good thing?

Is adding a trillion dollars of additional Medicaid spending to the clean CR is a good thing?

Tariffs are regressive taxes on American consumers. For decades most Americans have wanted a more progressive tax system.The OBBB prevented a massive tax hike that was scheduled to kick in next year.

If higher income taxes are a good thing, is the tax revenue being collected from the tariff taxes a good thing?

Is adding a trillion dollars of additional Medicaid spending to the clean CR is a good thing?

We’re in agreement that the OBBB headed off massive tax hike that was scheduled to kick in at the end of this year.Tariffs are regressive taxes on American consumers. For decades most Americans have wanted a more progressive tax system.

AI Overview

While the specific numbers vary across polls, recent surveys from sources like Gallup and the

Pew Research Center indicate that a majority of Americans consistently support raising taxes on the wealthy. This view is most prevalent among Democrats but also receives a significant level of support from independents and a notable minority of Republicans.

Overall public opinion

- A March 2025 Pew Research Center survey found that 58% of U.S. adults said tax rates on household income over $400,000 should be raised. This included 23% who said the rates should be raised "a lot".

- In April 2025, Gallup reported that 58% of Americans believe upper-income people pay too little in taxes, though this percentage has trended downward from a high of 77% in the 1990s.

- A February 2024 poll from Navigator Research found even higher support, with 79% of Americans supporting higher taxes on the rich, including 63% of Republicans.

- The Excessive Wealth Disorder Institute, aggregating polls from late 2024, found that an average of 67% of Americans supported a billionaire income tax, and 63% supported a wealth tax.

- https://www.google.com/search?q=poll+++"higher+taxes"+++"rich+people"&sca_esv=79b3e61bd2633932&source=hp&ei=0hjdaL3JBpOYptQP4OqO2Ag&iflsig=AOw8s4IAAAAAaN0m4voqpHkCtWIwzX1PusvPobWE6R_j&ved=0ahUKEwi9-u_f-oKQAxUTjIkEHWC1A4sQ4dUDCBA&uact=5&oq=poll+++"higher+taxes"+++"rich+people"&gs_lp=Egdnd3Mtd2l6IiVwb2xsICsgImhpZ2hlciB0YXhlcyIgKyAicmljaCBwZW9wbGUiMgUQIRigATIFECEYoAEyBRAhGKABSOytAVCRCFifqwFwB3gAkAEAmAGwAaABrReqAQQyOS43uAEDyAEA-AEBmAIroAKZGagCCsICGhAAGIAEGLQCGNQDGOUCGLcDGIoFGOoCGIoDwgIKEAAYAxjqAhiPAcICChAuGAMY6gIYjwHCAgsQABiABBiRAhiKBcICERAuGIAEGJECGNEDGMcBGIoFwgIKEAAYgAQYQxiKBcICCxAuGIAEGLEDGIMBwgIFEAAYgATCAggQABiABBixA8ICDhAuGIAEGLEDGIMBGIoFwgIXEC4YgAQYkQIYsQMY0QMYgwEYxwEYigXCAhAQLhiABBjRAxhDGMcBGIoFwgINEC4YgAQYQxjUAhiKBcICFhAuGIAEGLEDGNEDGEMYgwEYxwEYigXCAgsQABiABBixAxiDAcICERAAGIAEGJECGLEDGIMBGIoFwgIOEC4YgAQYsQMY0QMYxwHCAhEQLhiABBixAxjRAxiDARjHAcICCxAAGIAEGJIDGIoFwgIGEAAYFhgewgIIEAAYFhgKGB7CAgYQABgNGB7CAggQABgKGA0YHsICCRAAGBYYxwMYHsICCxAAGIAEGIYDGIoFwgIFEAAY7wXCAggQABiABBiiBMICBRAhGKsCmAMF8QVQ-AjnkGWsDpIHBDM1LjigB6awAbIHBDI4Lji4B4EZwgcJNy4xOS4xNC4zyAeHAQ&sclient=gws-wiz

We’re in agreement that the OBBB headed off massive tax hike that was scheduled to kick in at the end of this year.

And while the top 1% of earners account for 40% of tax revenue, and the top 10% account for 72% of tax revenues,

Fair point. But individual and business income taxes represent the lions share of federal tax revenues. What other forms of federal taxes could squeeze the ultra rich?That is only true of the income tax. The overall tax system is mildly progressive.

View attachment 2568435