UltraChad

Chaddius Maximus

- Joined

- Sep 1, 2024

- Posts

- 6,950

Why? I'm good enough to turn you into a play thinggy. Adrina.You're too easy. Do better.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Why? I'm good enough to turn you into a play thinggy. Adrina.You're too easy. Do better.

Advance estimates of U.S. retail and food services sales for December 2024, adjusted for seasonal

variation and holiday and trading-day differences, but not for price changes, were $729.2 billion, an

increase of 0.4 percent (±0.5 percent)* from the previous month, and up 3.9 percent (±0.5 percent) from

December 2023. Total sales for the 12 months of 2024 were up 3.0 percent (±0.5 percent) from 2023.

Fueled by solid demand, single-family construction moved higher in December despite several headwinds facing the industry, including high mortgage rates, elevated financing costs for builders and a lack of buildable lots.

Overall housing starts increased 15.8% in December to a seasonally adjusted annual rate of 1.50 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

Total housing starts for 2024 were 1.36 million, a 3.9% decline from the 1.42 million total from 2023. Single-family starts in 2024 totaled 1.01 million, up 6.5% from the previous year. Multifamily starts ended the year down 25% from 2023.

U.S. President Donald Trump on Thursday said he would demand that interest rates drop immediately, and that other countries should follow suit - marking his first broadside at Federal Reserve monetary policymaking since taking office just three days ago.

"With oil prices going down, I'll demand that interest rates drop immediately, and likewise they should be dropping all over the world," Trump told the World Economic Forum on Thursday in Davos, Switzerland.

U.S. house prices rose 0.3 percent in November, according to the Federal Housing Finance Agency (FHFA) seasonally adjusted monthly House Price Index (HPI®). House prices rose 4.2 percent from November 2023 to November 2024.

“Annual house price gains continued to moderate in November, with sales prices in all nine Census divisions exhibiting slower pace of growth than a year earlier,” said Dr. Anju Vajja, Deputy Director for FHFA’s Division of Research and Statistics. “The slowdown in price growth is likely due to higher mortgage rates contributing to cooling demand.”

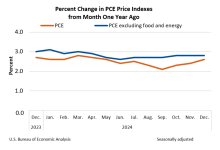

The Federal Reserve held interest rates steady Wednesday, its first pause following three consecutive cuts at the end of 2024.

The decision to hold comes as policymakers remain cautious about the direction of inflation and the potential effect of economic policies expected from the new Trump administration.

Th richest person on earth proving once again that's he's a total moron.

The only President to have a budget surplus in Elmo's lifetime and he's tweeting smack.

View attachment 2480966

The American economy ended 2024 on a solid note with consumer spending continuing to drive growth.

The Commerce Department reported Thursday that gross domestic product — the economy's output of goods and services — expanded at a 2.3% annual rate from October through December.

For the full year, the economy grew a healthy 2.8%, compared with 2.9% in 2023.

The European Central Bank cut its benchmark rate by a quarter point Thursday, underlining the contrast between more robust growth in the U.S. economy and stagnation in Europe, which recorded zero growth at the end of last year.

Alarms are being raised in the wake of a new report from the Washington Post claiming that allies of X owner Elon Musk have successfully pushed out the highest-ranking official at the United States Treasury Department over their demands to access highly sensitive government payment information.

According to the Post, longtime Treasury official David A. Lebryk is "expected to leave the agency soon" despite the fact that President Donald Trump actually appointed him as acting treasury secretary just last week.

The reason for Lebryk's departure is what has truly unnerved political observers, as the Post reports that he "had a dispute with Musk’s surrogates over access to the payment system the U.S. government uses to disburse trillions of dollars every year."

https://www.msn.com/en-us/money/com...1&cvid=d56bf752f3534d369b6ad32256ed266e&ei=99Julia Coronado, a clinical associate professor of finance at The University of Texas at Austin's McCombs School of Business, also worried about the implications of the Musk allies' actions.

"The man whose rocket just exploded over south Florida in spectacular fashion, who had the FAA head removed because he dared to be concerned about his safety practices, who is a little too cozy with China will now have unfettered access to confidential Treasury payment systems... what could go wrong?" she wrote.

The aides Elon Musk brought to help him purge the federal workforce have locked staffers of a U.S. government human resources agency out of the computer systems with millions of employees' personal information.

As Musk brings his staff to the Office of Personnel Management, senior officials' access to data systems is being revoked.

https://www.msn.com/en-us/news/us/g...1&cvid=dd5c1aece0ed454caed93d7080517d22&ei=50"We have no visibility into what they are doing with the computer and data systems," one of the officials said. "That is creating great concern. There is no oversight. It creates real cybersecurity and hacking implications."

One key database, the officials cited, is Enterprise Human Resources Integration, which has "all of the birthdates, Social Security numbers, appraisals, home addresses, pay grades and lengths of service of government workers."

Hedge funds last week jettisoned global stocks and added bets they would decline, said Goldman Sachs, just before U.S. President Trump announced tariffs that sent global markets tumbling.

Global shares slid on Monday after U.S. President Donald Trump announced sweeping tariffs on Canada, Mexico and China at the weekend, kicking off a trade war that could curb economic growth internationally.

The number of job openings decreased to 7.6 million on the last business day of December, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and total separations were little changed at 5.5 million and 5.3 million, respectively.

The number of job openings for November was revised up by 58,000 to 8.2 million, the number of hires was revised up by 104,000 to 5.4 million, and the number of total separations was revised up by 105,000 to 5.2 million.

Reading this "The number of job openings for November was revised up by 58,000 to 8.2 million, the number of hires was revised up by 104,000 to 5.4 million, and the number of total separations was revised up by 105,000 to 5.2 million."Unfilled job openings declined in December. More people started jobs than left jobs.

But November job openings and hires were revised upward.

Reading this "The number of job openings for November was revised up by 58,000 to 8.2 million, the number of hires was revised up by 104,000 to 5.4 million, and the number of total separations was revised up by 105,000 to 5.2 million."

...makes me think a slightly higher-than-usual number of folks were found after the fact to have quit one job and accepted another in a traditionally job-changing "dead zone" (pre-Christmas). This is unusual but not really cause for alarm, IMHO

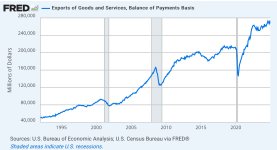

The US trade deficit widened sharply at the end of 2024 on a surge in imports prior to the start of Donald Trump’s second term as president and his follow-through on the promise of sweeping tariffs.

The December shortfall in goods and services trade grew nearly 25% from the prior month to $98.4 billion, Commerce Department data showed Wednesday. That culminated in a full-year deficit of $918.4 billion, the second-largest in data back to 1960.