Carnal_Flower

Literotica Guru

- Joined

- May 31, 2014

- Posts

- 6,896

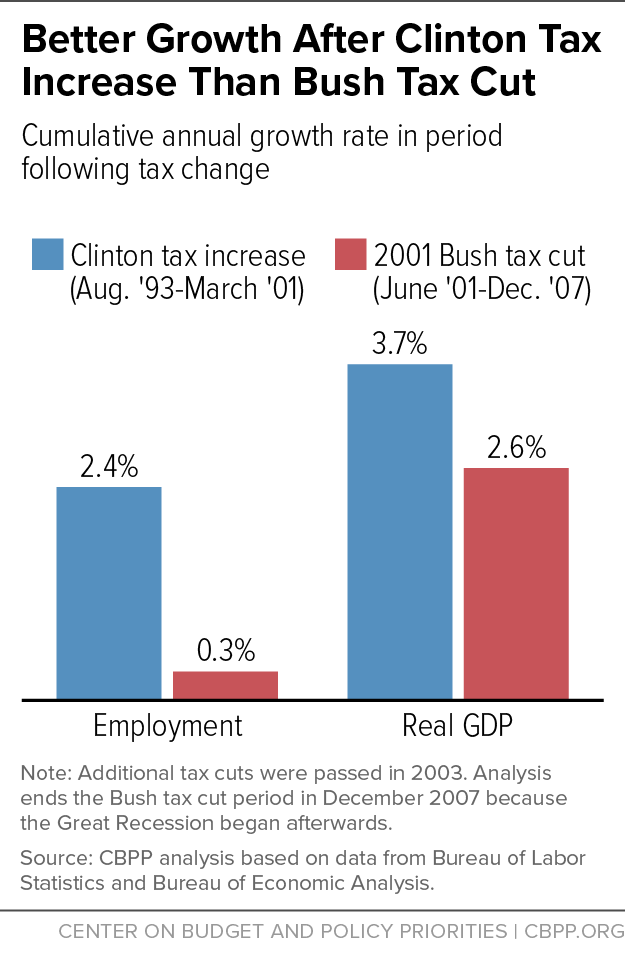

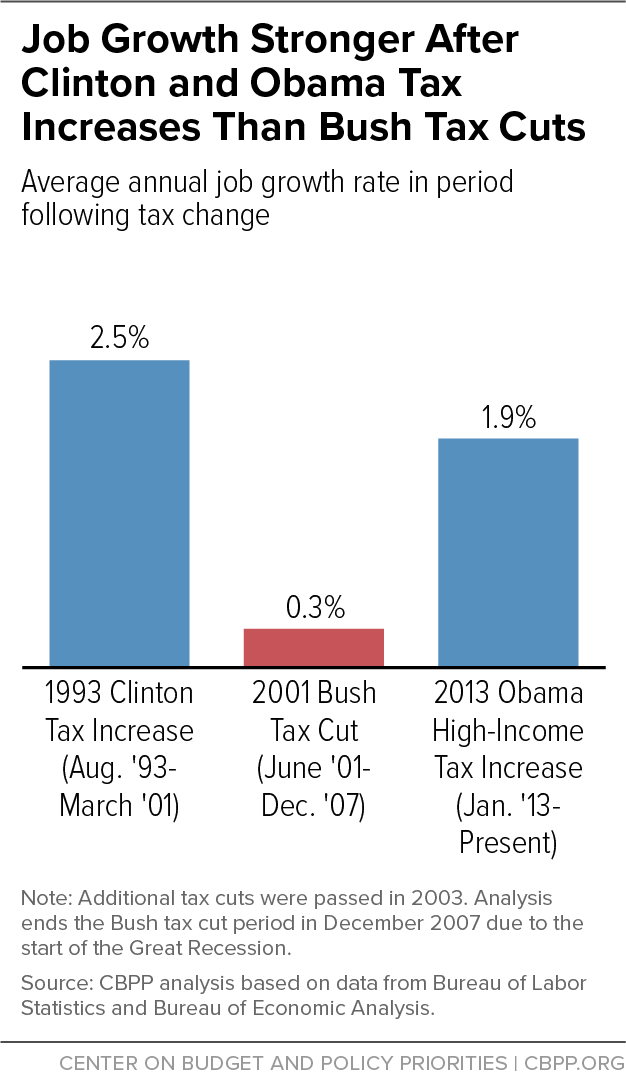

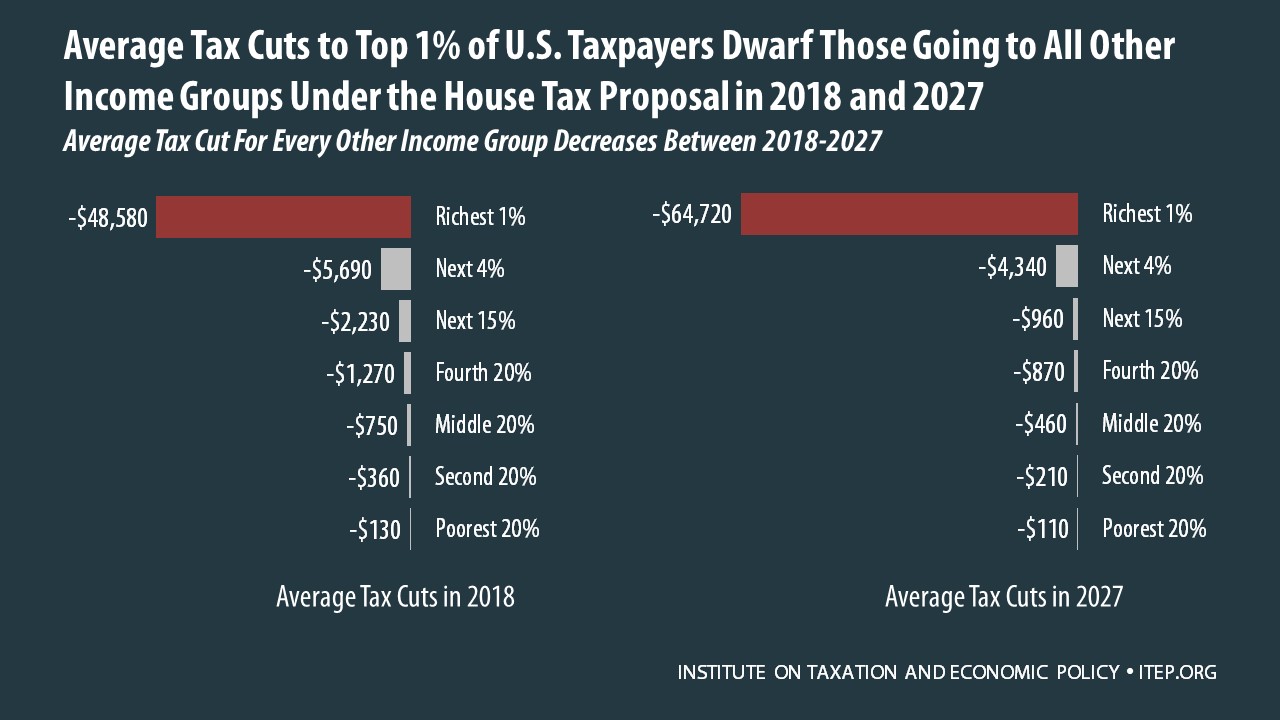

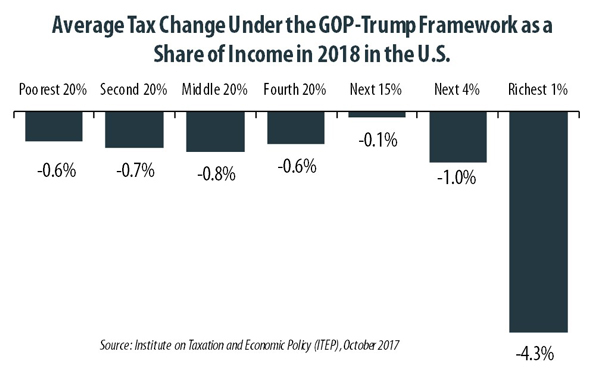

Oh, look at that, Marco Rubio admits the Tax Bill will NOT create "economic growth."

Of course, Rubio comes out with these things once in a while only to pretend he cares, because he wants to run for Pres some day.

"If I were king for a day, this tax bill would have looked different. I thought we probably went too far on (helping) corporations," Rubio said. "By and large, you're going to see a lot of these multinationals buy back shares to drive up the price. Some of them will be forced, because they're sitting on historic levels of cash, to pay out dividends to shareholders. That isn't going to create dramatic economic growth."

Of course, Rubio comes out with these things once in a while only to pretend he cares, because he wants to run for Pres some day.