trysail

Catch Me Who Can

- Joined

- Nov 8, 2005

- Posts

- 25,593

Well, let's see: 0.8% × 12 = 9.6% annual rate.

__________________

http://noir.bloomberg.com/apps/news?pid=20601110&sid=aysG2UXlVnNw

Wholesale Prices in U.S. Increase 0.8%, Led by Fuel

By Bob Willis

Feb. 16 (Bloomberg) -- Wholesale costs in the U.S. increased for a seventh consecutive month in January, led by higher prices for fuel.

The producer price index rose 0.8 percent, Labor Department figures showed today in Washington. The figure matched the median forecast in a Bloomberg News survey. The so-called core measure, which excludes volatile food and energy costs, rose 0.5 percent, the biggest rise since October 2008.

Growing economies in Asia and Latin America are boosting global demand for oil and other imported commodities, raising input costs for American factories. As the manufacturing industry rebounds, U.S. companies find it easier to pass along higher costs to corporate clients than to consumers, a sign the recovery is still broadening out.

“The big increase in energy and food prices is starting to feed through down the inflation pipeline, but the effects of higher prices are diminished as you go through the supply chain,” said Paul Dales, a senior U.S. economist at Capital Economics Ltd. in Toronto. “Even if manufacturers manage to push prices up, I can’t see retailers doing it at all.”

Futures on the Standard & Poor’s 500 Index expiring next month rose 0.3 percent to 1,330.80 at 8:32 a.m. in New York. The yield on the 10-year Treasury note, which moves inversely to price, was little changed from late yesterday at 3.61 percent.

Food, Energy

Estimates for January producer prices in the Bloomberg survey ranged from 0.3 percent to 1.4 percent. Prices excluding volatile food and energy costs were forecast to rise 0.2 percent for a second consecutive month.

The cost of food rose 0.3 percent in January from a month earlier, spurred by a 14 percent gain in vegetables. Energy prices rose 1.8 percent, led by higher diesel fuel and gasoline.

The cost of passenger cars fell 0.1 percent last month and were down 2 percent for the prior 12 months.

Prices for some finished consumer goods such as pharmaceutical preparations, tires and toys also boosted the headline number in January.

Prices of capital goods rose 0.3 percent last month after a 0.1 percent gain in December.

Expenses for intermediate goods rose 1.1 percent from the prior month and were up 6 percent from a year earlier, today’s report showed.

Prices of crude goods increased 3.3 percent in January from the previous month, and surged 10 percent for the 12-month period.

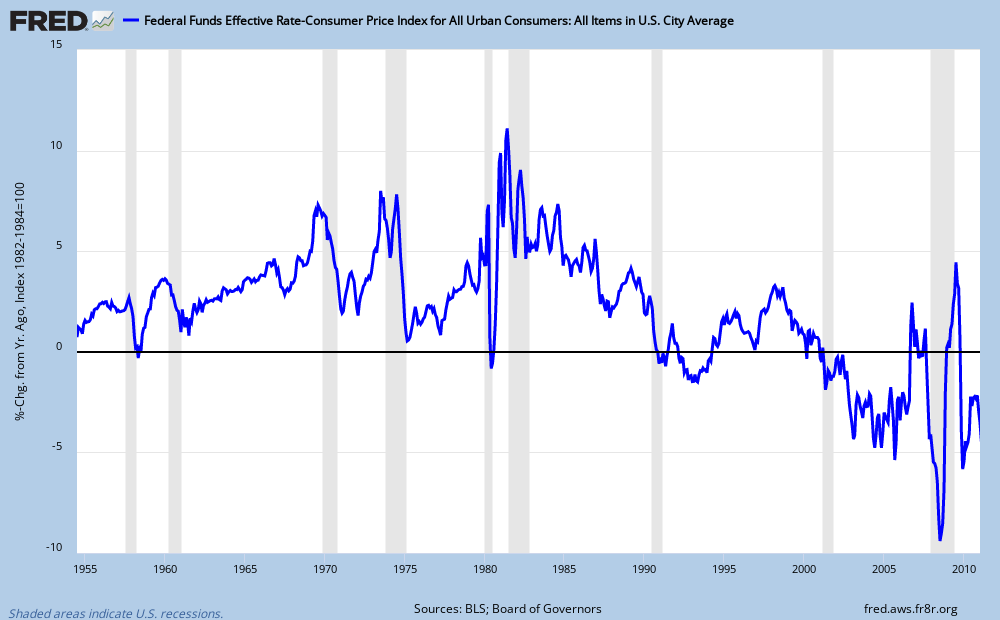

Even with soaring commodity costs, the Fed remains concerned that consumer inflation is below its annual target of 1.6 percent to 2 percent.

Commodity Prices

“Although commodity prices have risen, longer-term inflation expectations have remained stable, and measures of underlying inflation have been trending downward, the Fed said Jan. 26 after its latest policy meeting. “Although the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, progress toward its objectives has been disappointingly slow.”

An unemployment rate that’s held at or above 9 percent since May 2009 is also restraining labor costs. The threat of deflation, or a prolonged decline in prices that’s harmful to the economy, prompted Fed policy makers November 3 to announce the central bank’s purchase of $600 billion in additional Treasury securities by the end of June.

Producers are having varying degrees of success in raising prices for wholesalers.

PepsiCo Inc.

PepsiCo Inc., the world’s largest snack-food maker, last week posted a drop in fourth-quarter profit and projected full- year earnings growth that trailed analysts’ estimates as commodity costs increase.

PepsiCo Chief Executive Officer Indra Nooyi said the forecast reflects “extraordinary” costs for raw materials, and that raising prices likely will be difficult.

PepsiCo’s commodity costs may rise by $1.4 billion to $1.6 billion this year, Chief Financial Officer Hugh Johnston said on a conference call. The company, which plans to make up for some of that by raising prices, probably won’t be able to recover the full expense.

Illinois Tool Works, a Glenview, Illinois-based diversified manufacturer of engineered products and specialty systems, is one company that has been able to pass on higher costs to customers.

“Costs have continued to rise, even in the first quarter, for things like steel,” Ronald D. Kropp, chief financial officer, said in a conference call on Jan. 31. “We have put price increases in place. Our goal is to recover not just the cost, but also the margin.”

Goods Imported

Producer prices are one of three monthly inflation gauges reported by the Labor Department. Prices of goods imported into the U.S., released yesterday, rose 1.5 percent in January from the prior month, more than the Bloomberg survey median.

Consumer prices, the broadest of the three measures, probably climbed 0.3 percent in January from the prior month, according to the Bloomberg survey. The figures, due tomorrow, may also show the cost of living excluding fuel and food rose 0.1 percent for a third month.