Super-Surprise

Loves ****

- Joined

- Mar 28, 2008

- Posts

- 74,462

Bitcoin Is Getting Smoked To Start The New Year

Bitcoin Is Getting Smoked To Start The New Year

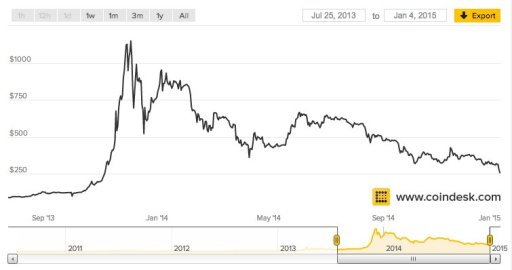

Bitcoin is under $300 for the first time since November of 2013. It's down ~16% to start 2015.

After peaking at $1,147.25 in December of 2013, it's been one long, slow descent for Bitcoin.

It's not good for Bitcoin, which had tremendous hype when its price was exploding. But, it's not necessarily the worst thing in the world, either.

Fred Wilson, a startup investor who is bullish on bitcoin, said the following in a blog post about what he thinks happens in 2015:

8/ The horrible year that bitcoin had in 2014 will be a wakeup call for all stakeholders. Developers will turn their energy from creating the next bitcoin (all the alt stuff) to creating the stack on top of the bitcoin blockchain. Real decentralized applications will start to emerge as the platform matures and entrepreneurial energy is channeled in the right direction.

In theory, as the price continues to drop, it could push developers to build applications.

https://ca.finance.yahoo.com/news/bitcoin-getting-smoked-start-154151501.html

Bitcoin Is Getting Smoked To Start The New Year

Bitcoin is under $300 for the first time since November of 2013. It's down ~16% to start 2015.

After peaking at $1,147.25 in December of 2013, it's been one long, slow descent for Bitcoin.

It's not good for Bitcoin, which had tremendous hype when its price was exploding. But, it's not necessarily the worst thing in the world, either.

Fred Wilson, a startup investor who is bullish on bitcoin, said the following in a blog post about what he thinks happens in 2015:

8/ The horrible year that bitcoin had in 2014 will be a wakeup call for all stakeholders. Developers will turn their energy from creating the next bitcoin (all the alt stuff) to creating the stack on top of the bitcoin blockchain. Real decentralized applications will start to emerge as the platform matures and entrepreneurial energy is channeled in the right direction.

In theory, as the price continues to drop, it could push developers to build applications.

https://ca.finance.yahoo.com/news/bitcoin-getting-smoked-start-154151501.html